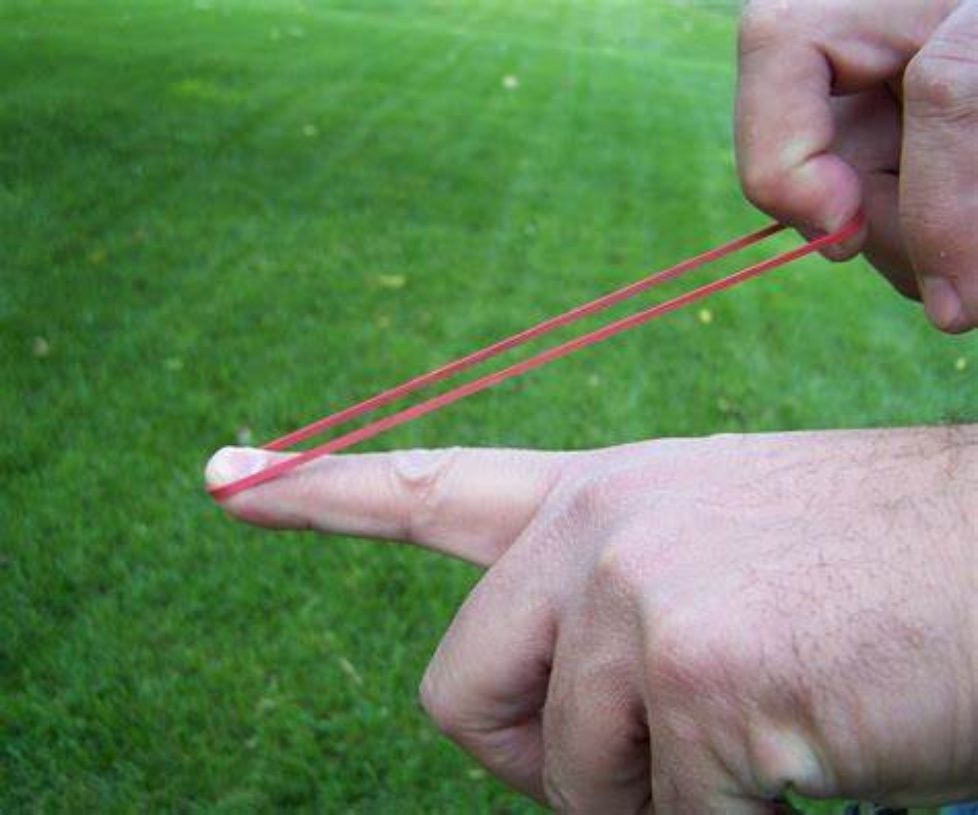

Think back. You’re all of 8 years old and you find a rubber band. You pick it up and inspect it, finding it to be pliable. Stretchy rubber bands are good for one thing to a kid: to be put on a finger and used as a projectile. In some respects, the way stocks (and at times, entire markets) behave is similar to stretching and releasing a rubber band.

To better understand market behavior, it is important to understand two technical terms:

An Oversold Market

“Oversold” refers to a condition where an asset has traded lower in price and has the potential for a price bounce. An oversold condition can last for a long time, and therefore being oversold does not mean a price rally will come soon, or at all. Many technical indicators identify oversold and overbought levels.1

An Overbought Market

“Overbought” is a term used when a security is believed to be trading at a level above its intrinsic (or fair market value). Overbought generally describes recent or short-term movement in the price of the security and reflects an expectation that the market will correct the price in the near future.2

How this information can be helpful to you

An oversold position is similar to a stretched rubber band…it might break, remain stretched, or be released at some point. An overbought position is similar to a rubber band that has soared across the room… it might land, bounce back, or keep soaring.

What you must keep in mind is that the oversold/overbought condition in a position or an entire market is not predictable, just like shooting a rubber band. Now consider your current mix of investments:

A lower-volatility (more conservative) investment portfolio is usually composed of fixed income instruments and dividend-yielding securities whose price does not typically move upward or downward rapidly. The goal of this portfolio is to produce a modest return over time. In other words, there’s usually not much stretch in this rubber band.

A higher-volatility (more aggressive) investment portfolio usually contains small and mid-sized company stocks, international and global stocks, large growth-oriented company stocks, and high yield fixed instruments, just to name a few. The goal of this portfolio is to produce higher returns over time compared to the low-volatility portfolio. Here, the rubber band is typically being stretched a lot.

The Bottom Line

Investing in the markets is going to produce variation in your account balance throughout the trading year. It’s the ebb and tide or contraction and advancement of the various positions held in your portfolio. Knowing more about the potential for an oversold and overbought condition of a position or the entire market helps you step back and take a longer view of your investments and remain true to your strategy.

There’s a lot that goes into designing a suitable investment strategy. Investors should determine when they’ll need the money, what they’ll be spending it on, and how much stretch they can tolerate in their rubber band prior to investing. A lot of research and hard work goes into choosing what goes into–and should remain out of–an appropriate, diversified portfolio. And that’s where Kingdom Wealth Management comes in. We would enjoy getting to know you better to learn what you want to accomplish with your hard-earned money to make appropriate recommendations for investing. And know this: we are always up for a good old fashioned rubber band war…and we promise not to go crying to our mom if you win!

Give us a call to set up an appointment today. We can be reached at 832-474-7381 or request an appointment online by clicking here.